Ghost Debts

The shadow financial system making money with unpaid loans

While many homeowners in European cities struggled to meet their mortgage payments, a shadow financial system quietly thrived on the back of unpaid loans. In the investigation #GhostDebts, we looked how with the deepening of the housing crisis, the European Commission intervened, granting banks permission to offload their non-performing loans (NPLs) to third-party investors.

In Greece, for example, this sparked the emergence of an entire network of shadow banks, giants in their own right, specializing in the acquisition and trading of NPL portfolios. These shadow players seized the opportunity presented by the distressed market, capitalizing on the misfortune of struggling homeowners.

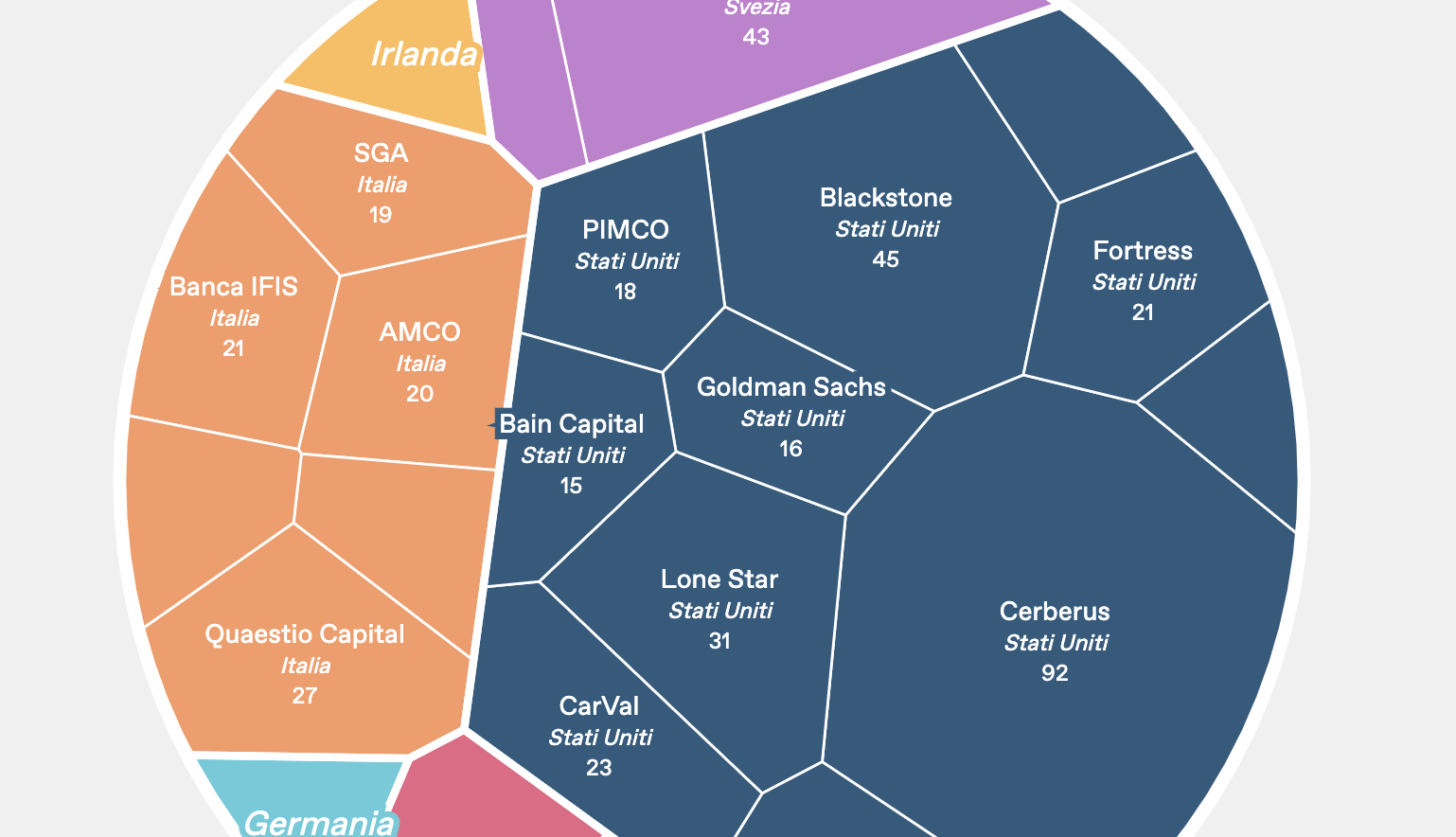

The biggest players in the market are companies with mythical-sounding names like ‘Cerberus,’ ‘Intrum,’ or ‘Lone Star.’ Many of these companies are headquartered in the US; some are debt collection companies, while others are mutual fund management companies.

Experts from the industry praise the system, speaking of more efficient management of bad loans by investors, which alleviates a significant burden for the banks. Critics express concern that an opaque shadow banking system is emerging. This concern arises because once the loans exit the banking system, they vanish from the purview of bank supervisors.

Meanwhile, insolvent debtors find themselves vulnerable to companies no longer affiliated with the bank from which they obtained the loan. Some of these companies employ aggressive debt collection agencies. Furthermore, bad loans can be resold multiple times, and in some instances, it remains unclear whose funds are involved in these resold loans. This ambiguity arises because money can be invested more discreetly through subcontractors, escaping notice.